Key Takeaways

- Rent reporting can turn your largest monthly expense into a valuable credit-building tool by adding verified rent payments to your credit reports, something landlords don’t typically do on their own.

- Consistent on-time payments combined with newer scoring models (FICO 9, FICO 10, VantageScore 3.0/4.0) can lead to meaningful increases, especially for renters with thin or no credit history.

- Choosing the right rent reporting service means comparing bureau coverage, costs, retroactive reporting options, and whether they report only positive payments or full payment history.

- To get the best results, renters should pay on time, monitor credit reports for accuracy, and pair rent reporting with solid financial habits.

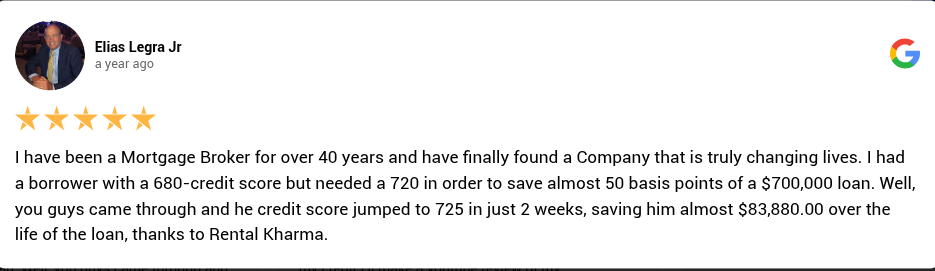

- Rental Kharma delivers quick credit gains by adding your full rental history to two major bureaus (TransUnion and Equifax), offering an average 40-point increase in days, plus unlimited 1-on-1 mentoring for long-term credit growth.

What Is Rent Reporting?

Rent reporting is the process of having your monthly rent payments added to your credit reports at the major credit bureaus. Unlike mortgage payments, credit card bills, or auto loans that lenders automatically report, rent payments traditionally haven’t been included in credit reports. This means millions of renters miss out on building credit through their largest monthly expense.

The reason for this gap is simple: landlords and property managers aren’t required to report rent payments to credit bureaus, and many find the process too costly or complicated. As a result, few renters have their rent payments reflected in their credit files.

Rent reporting services bridge this gap by acting as intermediaries between renters, landlords, and credit bureaus. These services verify your payment history with your landlord and then report that information to one or more of the three major credit bureaus: Equifax, Experian, and TransUnion.

Once reported, your rent payments become part of your credit history and can positively impact your credit scores.

Rental Kharma: The Fastest Way to Significantly Improve Your Credit Score!

Average 40-Point Score Increase | 4.2★ Google Rating

Get Credit You Deserve:

Add your entire rental payment history to TransUnion and Equifax—regardless of how you pay. See an average 40-point increase in days, plus an additional 60 points in 6–8 weeks with unlimited 1-on-1 mentoring included.

What’s Included:

- ✓ $75 past reporting + $8.95/month membership

- ✓ 720 Credit Ready guidance and no down payment loan strategies

- ✓ Pitfall avoidance to identify predatory lenders

- ✓ Unlimited mentoring sessions with ongoing support

Your largest monthly payment should build your credit. Make it count.

Why Reporting Rent Can Help Build Credit

Your payment history is the most critical factor in calculating your credit score, accounting for 35% of your FICO score. For renters who pay on time every month, rent reporting turns an invisible expense into a visible credit-building asset.

Research shows significant improvements in credit scores from rent reporting. A 2021 TransUnion study found that consumers who reported their rent saw an average increase of 60 points in their credit scores. Those with the most to gain are individuals with thin credit files or no credit history. The same study found that 9% of previously “unscorable” consumers became scorable after adding rent payments, with average scores rising to 631.

Rent reporting particularly benefits young adults building credit for the first time, immigrants establishing a U.S. credit history, individuals recovering from past credit challenges, and anyone with limited credit history. Adding years of on-time rent payments can make the difference between credit invisibility and credit opportunity.

Modern credit scoring models recognize rent payments. FICO Score 9, FICO Score 10, and VantageScore 3.0 and 4.0 all incorporate reported rental payment data into their calculations. While not all lenders have adopted these newer models yet, the trend toward including rent payments continues to grow.

How Rent Reporting Works: Step-by-Step

The process is simple and moves quickly, with most renters fully set up in just a few days. Here’s how it typically works:

- Choose a rent reporting service: Select a provider that fits your budget, and offers the features you need. Most services charge a setup fee plus a small monthly subscription.

- Landlord verification: The service contacts your landlord or property manager to confirm your address, lease dates, monthly rent amount, and payment history. Reputable providers make this step smooth and hassle-free.

- Reporting begins: Once verified, your ongoing rent payments are sent directly to the credit bureaus with which the service partners. Some providers can also report your full past payment history at your current address, giving you an immediate boost.

- Your account appears: Within 7–10 business days, your rental shows up on your credit report, listing your payment amounts, dates, and account details.

- Ongoing monthly reporting: As long as you keep your subscription active, each new on-time payment strengthens your credit profile and builds a more extended, more reliable payment history.

What to Look for in a Rent Reporting Service

Cost & Fee Structure

Prices differ significantly across providers. Setup fees can range from free to $95, and monthly subscriptions usually fall in the $5–$10 range. Some companies add extra charges for retroactive payment history, while others include it in the initial fee. Consider the total cost for an entire year and compare it to the credit-building value you expect to gain.

Free Rent Reporting Services

Services that are free have some major drawbacks for those wanting a quick score increase. They do not report past history since moving in and they require you to connect your checking account to their system to validate ongoing payments. Many renters do not consistently pay their rent from a checking account so this type of service will not work for them.

Retroactive Reporting

A service that can add your past rent payments right away gives you immediate credit-building benefits. Providers that can report your full history at your current address help you gain traction on your score without waiting months for new data to accumulate.

Security & Data Protection

Before submitting personal information, confirm that the company uses strong security practices, such as encryption and verified data handling. Reading customer reviews can help you gauge reliability and transparency.

Landlord Participation

Some services make landlord verification easy, speeding up the process and reducing friction. A streamlined system typically means faster verification and quicker reporting to the bureaus.

Tips for Maximizing Credit-Building with Rent Payments

Strong credit gains come from consistency, accuracy, and pairing rent reporting with smart financial habits. To get the best results, focus on the fundamentals below:

- Pay on time every month. Consistent payments are the foundation of rent reporting. A single late payment can weaken your progress if your service uses full-file reporting.

- Check your credit reports regularly. Visit creditkarma.com to confirm that your rental account appears correctly, including payment amounts, dates, and history.

- Add past rental history when possible. If your provider supports it, reporting previous on-time rent payments can give your score an immediate lift.

- Use rent reporting alongside other strategies. Keep balances low, pay all bills on time, and avoid unnecessary credit applications to strengthen your overall profile over time.

Essential Considerations Before Signing Up

Before enrolling in a rent reporting service, carefully evaluate whether the benefits outweigh the costs for your specific situation. If you already have strong credit with multiple positive accounts, adding rent may provide minimal score improvement. The most significant benefits go to those with thin credit files, no credit history, or scores below 660.

Service costs accumulate over time. Evaluate whether potential credit score increases justify expenses based on your credit goals and timeline. Some landlords may also be reluctant to participate in verification. Services with streamlined processes and professional support teams achieve higher landlord cooperation rates.

Build Credit the Smart Way with Rental Kharma

When you’re ready to build credit through your rent payments, Rental Kharma offers a comprehensive solution with over 12 years of experience and more than 125,000 families helped.

Rental Kharma reports your rental payment history to TransUnion and Equifax. The $75 one-time setup fee includes reporting ALL of your past rental payment history at your current address through a simple 5-minute landlord verification call, no additional charges for retroactive reporting. Our service works regardless of how you pay rent, whether by check, cash, money order, or electronic transfer.

What sets us apart is our human-powered approach with real people guiding you through the process. Same-day verifications expedite your credit reporting, and unlimited one-on-one mentoring sessions help you reach the goal of a 720 credit score. Members who complete the 30-minute mentoring session see an average increase of 60 points in just 6 to 8 weeks.

With a 90-day money-back guarantee, transparent pricing, and dedicated support, Rental Kharma makes credit-building accessible and practical.

Get Started with Rental Kharma →

Frequently Asked Questions (FAQs)

How long does it take to see my credit score increase after enrolling in a rent reporting service?

Most renters see their rental accounts appear within 7 to 10 business days after verification. If the service reports retroactive payment history, you may see an immediate score boost.

For ongoing payments only, noticeable improvements typically appear within 2 to 3 months. Those with thin credit files see faster improvements than those with established credit.

Will late rent payments hurt my credit if I use a rent reporting service?

Late payments in credit only affect you when you are 30 days late. Being 10 days late and paying a late fee will impact your pocketbook but not your credit score.

Can I report past rent payments or only future payments?

Many services offer retroactive reporting for past rent payments. The amount varies; some limit it to 12 or 24 months with additional fees, while others report your entire history at your current address.

Retroactive reporting instantly adds positive payment history rather than requiring months to accumulate.

How does Rental Kharma help renters build credit faster compared to other rent reporting services?

Rental Kharma stands out by reporting your full rental history to both TransUnion and Equifax, delivering an average 40-point increase in just days and even larger gains in the following weeks.

Unlike most services, we also include unlimited 1-on-1 mentoring to guide you toward stronger long-term credit habits, making it one of the most comprehensive credit-building options for renters.

*Disclaimer: Credit score improvements vary by individual based on credit history, payment consistency, and scoring models. The results mentioned are averages and not guaranteed. For current pricing, visit Rental Kharma’s website. This article is for educational purposes only, not financial advice.