Key Takeaways

- A 720 credit score places you in the prime lending tier, meaning you can qualify for auto loans with strong approval odds and competitive interest rates.

- You’ll receive better loan rates than subprime borrowers, though borrowers with scores above 780 may still qualify for slightly lower interest rates.

- You can choose from multiple financing options: dealerships, banks/credit unions, and online lenders, each offering different advantages in terms of rates and convenience.

- To secure the best possible auto loan, get preapproved, compare offers, negotiate your rate, consider shorter loan terms, and improve your credit further by lowering utilization and reporting rent payments.

- Rental Kharma can help you push your score higher before applying for an auto loan by reporting your rent payments to TransUnion and Equifax, potentially unlocking even better rates.

What Does a 720 Credit Score Mean for Car Buying?

If you’re wondering whether a 720 credit score is good enough to buy a car, the short answer is yes.

A 720 score places you in the “good” category on the FICO scale. More importantly, lenders classify borrowers with scores between 661 and 780 as “prime” borrowers. This signals that you’re reliable, pay bills on time, and handle debt responsibly.

With a 720 score, most auto lenders will be eager to work with you. Whether you’re buying new or used, financing through a dealership or going directly to a bank, you’ll find plenty of options available. You won’t face the rejection, steep down payment requirements, or sky-high rates that subprime borrowers encounter.

However, while 720 is solid, it sits at the lower end of the prime category. Borrowers with scores above 780 receive the absolute best rates. This means there’s still room to improve your position before applying for an auto loan.

Rental Kharma: The Fastest Way to Significantly Improve Your Credit Score!

Average 40-Point Score Increase | 4.2★ Google Rating

Get Credit You Deserve:

Add your entire rental payment history to TransUnion and Equifax—regardless of how you pay. See an average 40-point increase in days, plus an additional 60 points in 6–8 weeks with unlimited 1-on-1 mentoring included.

What’s Included:

- ✓ $75 past reporting + $8.95/month membership

- ✓ 720 Credit Ready guidance and no down payment loan strategies

- ✓ Pitfall avoidance to identify predatory lenders

- ✓ Unlimited mentoring sessions with ongoing support

Your largest monthly payment should build your credit. Make it count.

What Interest Rates Can You Expect with a 720 Credit Score?

Your credit score is one of the biggest factors lenders use to determine your interest rate. With a 720 score, you’ll qualify for rates significantly better than subprime borrowers, though not quite as low as those offered to borrowers with exceptional credit.

For new car purchases, prime borrowers typically receive interest rates well below the national average. Used car loans come with slightly higher rates across all credit tiers because used vehicles represent more risk to lenders.

The difference between a prime rate and a subprime rate adds up dramatically over the life of a loan. On a typical auto loan, the gap can amount to thousands of dollars in extra interest. This is money that stays in your pocket when you have good credit.

Even within the prime category, small rate differences matter. If you can push your score from 720 into the mid-700s before applying, you could save a meaningful amount over a five or six-year loan term.

Types of Auto Loans Available to You

Dealership Financing

Most car dealerships offer their own financing options, which can be convenient since you can handle everything in one place. When you fill out a credit application at the dealership, their finance department sends your information to multiple lenders and presents you with loan offers. However, dealerships often mark up the interest rate above what the lender originally proposed, keeping the difference as profit. This means the rate they offer you may not be the best rate you actually qualify for.

Banks and Credit Unions

Going directly to a bank or credit union often results in lower interest rates than dealership financing. Credit unions, in particular, are known for offering competitive rates to their members. The application process takes a bit more effort since you’ll need to get preapproved before shopping for your car, but the savings can be substantial. Many credit unions also offer relationship discounts if you have other accounts with them.

Online Lenders

Online lenders have become increasingly popular for auto financing. They often provide quick approval decisions and competitive rates. Some online platforms allow you to compare offers from multiple lenders at once, making it easier to shop around. The convenience of applying from home and the ability to easily compare options make this an attractive choice for many borrowers.

How to Get the Best Auto Loan Rate with a 720 Score

Having a 720 credit score puts you in a strong position, but that doesn’t mean you should accept the first loan offer that comes your way. Taking a few strategic steps can help you secure an even better deal.

Get Preapproved Before Visiting the Dealership

One of the best moves you can make is getting preapproved for an auto loan before you start shopping for a car. When you walk into a dealership with a preapproval letter in hand, you have leverage. The dealership knows they’ll have to beat your existing offer if they want to earn your financing business. This shifts the negotiating power to your side.

Preapproval also helps you understand exactly how much car you can afford and what interest rate you qualify for. This prevents you from falling in love with a vehicle that’s outside your budget and protects you from accepting unfavorable terms out of excitement.

Shop Around and Compare Offers

Don’t settle for the first rate you’re offered. Contact multiple lenders, including your bank, local credit unions, and online lenders, to see what rates they can provide. When you shop for auto loans within a short window, typically 14 to 45 days, multiple credit inquiries are treated as a single inquiry for scoring purposes. This means you can compare offers without worrying about damaging your credit score.

Negotiate the Interest Rate

Many people don’t realize that auto loan interest rates are negotiable. If a dealer offers you a rate, you can ask if they can do better. Mention the lower rates you’ve seen from other lenders. Negotiating can be as simple as asking whether those are the best terms they can offer. Even a small reduction in your interest rate can save you hundreds of dollars over the life of the loan.

Consider a Shorter Loan Term

While longer loan terms mean lower monthly payments, they also mean paying more interest over time. If you can afford higher monthly payments, choosing a shorter term, such as 48 or 60 months instead of 72 or 84, will save you money and help you build equity in your vehicle faster. Shorter terms also often come with lower interest rates.

Make a Larger Down Payment

Putting more money down upfront reduces the amount you need to borrow, which means less interest paid over time. A larger down payment can also help you qualify for better rates since lenders see you as less risky when you have more skin in the game.

How to Improve Your Credit Score Before Buying a Car

Pay All Bills on Time

Payment history is the most important factor in your credit score. Even one late payment can cause your score to drop significantly. Set up automatic payments or calendar reminders to ensure you never miss a due date.

Keep Credit Utilization Low

Your credit utilization ratio, the amount of credit you’re using compared to your total available credit, has a major impact on your score. Aim to keep this ratio as low as possible. Paying down credit card balances before applying for an auto loan can give your score a quick boost.

Report Your Rent Payments

If you’re a renter, you’re likely making one of your largest monthly payments without getting any credit for it. Rent payments don’t automatically appear on your credit report, but services like Rental Kharma can change that. By reporting your rent payments to the credit bureaus, you can add positive payment history to your credit file and potentially increase your score before applying for an auto loan.

Monitor Your Credit Reports

Check your credit reports regularly for errors or inaccuracies. Mistakes happen, and an error on your report could be dragging down your score unfairly. You’re entitled to free annual credit reports from all three major bureaus, so take advantage of this and dispute any errors you find.

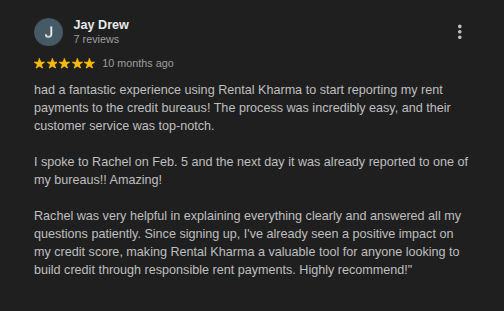

Strengthen Your Credit with Rental Kharma

If you’re looking to boost your credit score before applying for an auto loan, Rental Kharma offers a proven solution backed by years of experience helping more than 125,000 families build credit.

Rental Kharma reports your complete rental payment history to TransUnion and Equifax, turning your largest monthly expense into credit-building power. The $75 one-time setup fee includes reporting all past rental payments at your current address through a simple 5-minute landlord verification call. Unlike other services, there are no hidden charges for retroactive reporting.

For someone with a 720 credit score looking to push into the “very good” or “excellent” range before a major purchase, rent reporting can make a meaningful difference. The average member sees a 40-point increase within days, which could be enough to move you into a higher credit tier and qualify for better auto loan rates.

What truly sets Rental Kharma apart is unlimited one-on-one mentoring. Our credit experts guide you through the entire credit-building journey, helping you understand your reports, develop smart financial habits, and work toward a 720+ credit score. Members who complete the 30-minute mentoring session see an average increase of 60 points in just 6 to 8 weeks.

With same-day verifications, transparent pricing, a 90-day money-back guarantee, and dedicated support, Rental Kharma makes strengthening your credit accessible and practical.

Get Started with Rental Kharma →

Frequently Asked Questions (FAQs)

Is a 720 credit score good enough to buy a car?

Yes, a 720 credit score is considered “good” and places you in the prime borrower category. You’ll qualify for most auto loans and receive competitive interest rates. While you may not get the absolute lowest rates reserved for borrowers with exceptional credit (780+), you’re in a strong position to finance a vehicle with favorable terms.

Can I negotiate my auto loan interest rate?

Absolutely. Many car buyers don’t realize that interest rates are negotiable. Dealerships often mark up rates above what lenders originally propose, leaving room for negotiation. You can ask the dealer if they can offer better terms or show them lower rates you’ve received from other lenders. Even a small reduction can save you hundreds of dollars over the life of your loan.

Should I get preapproved before going to the dealership?

Getting preapproved is one of the best strategies for securing a good auto loan. It gives you a clear understanding of your budget and the rates you qualify for. More importantly, it provides leverage when negotiating with the dealership. If they want your financing business, they’ll need to beat or match your preapproved offer.

How can Rental Kharma help me get a better auto loan rate?

Rental Kharma reports your rent payments to TransUnion and Equifax, adding positive payment history to your credit file. This can help boost your credit score before you apply for an auto loan. A higher score typically qualifies you for lower interest rates, which means paying less over the life of your loan. With Rental Kharma’s $75 one-time fee and unlimited credit mentoring, you get a straightforward path to improving your credit profile.

*Disclaimer: Credit score improvements vary by individual based on credit history, payment consistency, and scoring models. The results mentioned are averages and not guaranteed. For current pricing, visit Rental Kharma’s website. This article is for educational purposes only, not financial advice.