Key Takeaways

- Rent reporting turns your monthly rent payments into a documented credit tradeline, helping you build credit even if you have no prior history.

- The process works by verifying your payments and submitting them to credit bureaus, with most renters seeing results on their reports within 30–60 days.

- Adding rent payments to your credit file strengthens payment history, benefiting renters with thin credit files, no credit, or those rebuilding credit.

- Rent reporting builds credit without taking on debt, and retroactive reporting lets you add months or years of past payments for faster score improvement.

- Rental Kharma is one of the most effective options, reporting past and future payments to two major bureaus and providing unlimited mentoring to support long-term credit growth.

What Is Rent Reporting?

Rent reporting is a service that records your monthly rent payments and submits them to one or more of the three major credit bureaus: Equifax, Experian, and TransUnion. Once reported, your rent payment history appears on your credit report and can positively influence your credit score.

Traditionally, rent payments haven’t helped renters build credit. Unlike mortgages, car loans, or credit cards, landlords typically don’t report rent to credit bureaus. This creates an unfair gap where homeowners build credit by paying their mortgages each month, while renters paying similar amounts see no credit benefit.

Rent reporting services bridge this gap. They verify your payments and report them to credit bureaus on your behalf, giving you credit for the financial responsibility you’re already demonstrating. For renters who pay on time consistently, this can be a game-changer for building or improving credit.

Rental Kharma: The Fastest Way to Significantly Improve Your Credit Score!

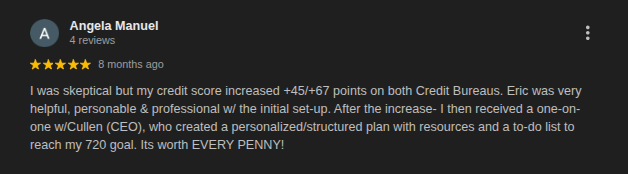

Average 40-Point Score Increase | 4.2★ Google Rating

Get Credit You Deserve:

Add your entire rental payment history to TransUnion and Equifax—regardless of how you pay. See an average 40-point increase in days, plus an additional 60 points in 6–8 weeks with unlimited 1-on-1 mentoring included.

What’s Included:

- ✓ $75 past reporting + $8.95/month membership

- ✓ 720 Credit Ready guidance and no down payment loan strategies

- ✓ Pitfall avoidance to identify predatory lenders

- ✓ Unlimited mentoring sessions with ongoing support

Your largest monthly payment should build your credit. Make it count.

How Does Rent Reporting Work?

The rent reporting process is straightforward and typically involves a few simple steps.

1. Enrollment

You sign up with a rent reporting service and provide basic information about your rental situation, including your address, landlord contact information, and lease details. Some services require you to link your bank account so payments can be verified automatically.

2. Verification

The service verifies your rent payments, either through bank account data, landlord confirmation, or both. Verification methods vary by provider. Some require landlord participation, while others can verify payments directly through your banking information.

3. Reporting

Once verified, your rent payments are reported to one or more credit bureaus. A rental tradeline, which is essentially a record of your rent account, appears on your credit report. This tradeline includes details like when the account was opened and your payment history.

4. Retroactive Reporting

Many services offer the option to report past rent payments, not just future ones. This feature is valuable because it allows you to add months or even years of positive payment history to your credit file immediately. Some services can report up to 24 months of past payments.

Most renters see the rental tradeline appear on their credit reports within 30 to 60 days after their first payment is reported. The timeline varies depending on the service and how quickly credit bureaus process the information.

How Rent Reporting Affects Your Credit Score

Payment History Is King

Payment history is the single most important factor in calculating your credit score. It accounts for roughly 35% of your FICO score and about 40% of your VantageScore. When your on-time rent payments are reported, they contribute to this crucial category, demonstrating to lenders that you reliably meet your financial obligations.

Scoring Model Matters

Not all credit scoring models treat rent payments the same way. Newer models like FICO 9, FICO 10, and VantageScore 3.0 and 4.0 incorporate rent payment data into their calculations. However, older models like FICO 8, which many lenders still use, don’t factor in rent payments.

This means the impact of rent reporting can vary depending on which scoring model a lender uses. Even so, having rent payments on your credit report builds a documented history that can benefit you as more lenders adopt newer scoring models.

Who Benefits Most

Rent reporting tends to have the greatest impact for people with thin credit files or no credit history at all. If you’re “credit invisible” with no credit file, or “unscorable” because you have too little information for bureaus to calculate a score, rent reporting can help establish your credit identity.

People rebuilding credit after financial difficulties also benefit significantly. Adding consistent on-time rent payments to your report demonstrates current financial responsibility, even if past accounts show negative marks.

Benefits of Rent Reporting

Rent reporting offers several advantages that make it an attractive credit-building strategy.

Build Credit Without Debt

Unlike credit cards or loans, rent reporting lets you build credit without borrowing money or paying interest. You’re simply getting credit for payments you’re already making. There’s no risk of accumulating debt or paying interest charges.

Leverage Your Largest Expense

For most renters, rent is their biggest monthly expense. It makes sense to get credit-building value from this significant financial commitment rather than letting it go unrecognized.

Establish History Faster

With retroactive reporting, you can instantly add months of positive payment history to your credit file. This accelerates the credit-building process compared to starting from scratch with a new credit card or loan.

Improve Future Approval Odds

A stronger credit profile with documented payment history improves your chances of approval for credit cards, auto loans, mortgages, and even future rental applications. Some landlords now consider reported rent history when screening tenants.

What to Look for in a Rent Reporting Service

Number of Credit Bureaus

Some services report to only one credit bureau, while others report to two or all three. Reporting to multiple bureaus maximizes your credit-building potential since lenders may pull your report from any of them.

Retroactive Reporting

The ability to report past payments is a significant advantage. Services that include retroactive reporting let you add your existing payment history to your credit file immediately, rather than building from zero going forward.

Landlord Requirements

Some services require your landlord to verify payments or participate in the process. Others can verify payments through your bank account, requiring no landlord involvement. If your landlord is uncooperative or hard to reach, a service that doesn’t require their participation is essential.

Pricing Structure

Costs vary widely among rent reporting services. Some charge monthly fees, others have one-time setup fees, and some combine both. A few free options exist, but they often report to only one bureau. Consider the total cost against the potential credit-building benefits.

Positive-Only vs. Full-File Reporting

Some services only report on-time payments, protecting you if you’re occasionally late. Others use full-file reporting, meaning late or missed payments could also be reported and potentially hurt your score. Understand what happens if you miss a payment before signing up.

Best Rent Reporting Services

Rental Kharma

Rental Kharma reports your complete rental payment history to both TransUnion and Equifax, giving you coverage with two major bureaus. What sets us apart is our commitment to reporting all past payments at your current address, not just future ones. This means you can instantly add your existing positive payment history to your credit file.

Our service uses a simple landlord verification process that takes about five minutes, making setup quick and hassle-free. For a $75 one-time setup fee, you get retroactive reporting included with no hidden charges. Ongoing reporting is available through affordable monthly plans.

Beyond reporting, we provide unlimited one-on-one credit mentoring. Our experts help you understand your credit reports, develop smart financial habits, and work toward long-term credit goals. This educational component adds significant value beyond basic rent reporting.

Other Options

Several other services exist in the market. Some, like Experian Boost, are free but only report to one bureau. Others may charge higher monthly fees or require extensive landlord involvement. When comparing options, weigh the number of bureaus covered, retroactive reporting capabilities, landlord requirements, and total cost.

Build Credit Smarter with Rental Kharma

You’re already paying rent every month. The question is whether that money is working for your financial future.

Rental Kharma exists to ensure it does. By reporting your rent payments to TransUnion and Equifax, we turn your largest monthly expense into documented proof of your financial reliability. It’s credit building that fits seamlessly into your life because it’s based on what you’re already doing.

What makes us different is the complete picture approach. The $75 one-time setup fee covers reporting of all your past rent payments at your current address, not just the payments you make after signing up. While other services might charge extra for retroactive reporting or limit how far back they’ll go, we include your full history from day one.

The verification process is designed to be effortless. A quick 5-minute call with your landlord confirms your payment history, and same-day verifications mean you’re not waiting weeks to get started. Transparent pricing means no surprise fees down the road.

But Rental Kharma goes beyond just reporting numbers to credit bureaus. Every member gets access to unlimited one-on-one credit mentoring with real experts who understand the credit system inside and out. We’ll help you read your credit reports, identify opportunities for improvement, and build habits that serve you for years to come. Members who take advantage of the mentoring session see significantly better results.

With years of experience and more than 125,000 families helped, we have refined the rent reporting process to deliver real results. And with a 90-day money-back guarantee, there’s no risk in getting started.

Your rent payments represent years of financial responsibility. It’s time they counted.

Get Started with Rental Kharma →

Frequently Asked Questions (FAQs)

Will rent reporting hurt my credit score?

For most people, rent reporting helps rather than hurts. Adding on-time payments builds positive payment history, which is the most important factor in your score. However, if a service uses full-file reporting and you miss a payment, that could negatively impact your score. Additionally, adding a new tradeline might cause a small, temporary dip for people with long-established credit histories due to changes in average account age.

Do I need my landlord’s permission to report rent?

It depends on the service. Some rent reporting services require landlord verification or participation, while others can verify payments through your bank account without landlord involvement. Rental Kharma uses a simple landlord verification call that takes about five minutes, making the process quick and straightforward for both you and your landlord.

How quickly will I see results from rent reporting?

Most renters see a rental tradeline appear on their credit reports within 30 to 60 days after the first payment is reported. The impact on your credit score varies based on your existing credit profile. People with thin files or no credit history often see more significant improvements than those with established credit. Services that offer retroactive reporting can add positive history immediately, rather than building from zero.

What makes Rental Kharma different from other services?

Rental Kharma reports to two major credit bureaus (TransUnion and Equifax) and includes all past payments at your current address with the one-time $75 setup fee. Unlike services that charge extra for retroactive reporting or only cover one bureau, Rental Kharma provides comprehensive coverage from the start. The unlimited credit mentoring sets it apart further, giving members personalized guidance to maximize their credit-building results.

*Disclaimer: Credit score improvements vary by individual based on credit history, payment consistency, and scoring models. The results mentioned are averages and not guaranteed. For current pricing, visit Rental Kharma’s website. This article is for educational purposes only, not financial advice.