Key Takeaways

- Past rent payments can be reported to credit bureaus through third-party services, allowing renters to add months or even years of positive payment history to their credit reports.

- Retroactive rent reporting accelerates credit building, since payment history carries the most weight in credit scores and doesn’t require taking on new debt.

- How far back you can report depends on the service, with many capping history at 24-48 months, while others can report your entire history at your current address.

- Successful reporting requires proper verification and preparation, including landlord confirmation, accurate documentation, and choosing a service that reports to multiple credit bureaus.

- Among the available services, Rental Kharma stands out for allowing you to report your entire rent history at your current address, making it a strong option for long-term renters looking to reflect a fuller track record.

Can You Report Past Rent Payments to Credit Bureaus?

Yes, you can report past rent payments to credit bureaus, and doing so can significantly accelerate your credit-building journey. While landlords don’t automatically report rent payments the way mortgage lenders report home loan payments, third-party rent reporting services can submit your historical rent data to credit bureaus on your behalf.

This process is called retroactive reporting or past rent reporting. Instead of only reporting your rent payments going forward from the day you sign up, these services verify and report payments you’ve already made, sometimes going back several years.

The ability to report past rent is valuable because it lets you get credit for the responsible payment history you’ve already established. If you’ve been paying rent on time for years, that track record deserves recognition on your credit report.

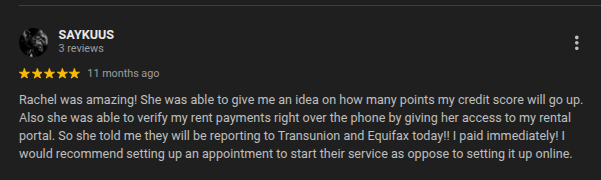

Rental Kharma: The Fastest Way to Significantly Improve Your Credit Score!

Average 40-Point Score Increase | 4.2★ Google Rating

Get Credit You Deserve:

Add your entire rental payment history to TransUnion and Equifax—regardless of how you pay. See an average 40-point increase in days, plus an additional 60 points in 6–8 weeks with unlimited 1-on-1 mentoring included.

What’s Included:

- ✓ $75 past reporting + $8.95/month membership

- ✓ 720 Credit Ready guidance and no down payment loan strategies

- ✓ Pitfall avoidance to identify predatory lenders

- ✓ Unlimited mentoring sessions with ongoing support

Your largest monthly payment should build your credit. Make it count.

Why Reporting Past Rent Payments Matters

Instantly Add Positive Payment History

Payment history is the most important factor in your credit score, accounting for roughly 35 to 40 percent of your score, depending on the model. When you report past rent payments, you instantly add months or years of documented on-time payments to your credit file.

This is significantly more impactful than starting from zero. Instead of waiting months to build a payment history, you can demonstrate years of responsible payment behavior immediately.

Build Credit Faster

For renters with thin credit files or no credit history, adding past rent payments can jumpstart the credit-building process. Rather than slowly accumulating payment history month by month, retroactive reporting compresses that timeline dramatically.

If you’re planning a major purchase like a home or car in the near future, this accelerated credit building can make a meaningful difference in the rates and terms you qualify for.

Maximize Your Existing Track Record

You’ve already done your duty of paying rent on time. Retroactive reporting simply ensures that effort is reflected in your credit profile. Without it, years of responsible payments remain invisible to lenders and creditors who evaluate your creditworthiness.

How Retroactive Rent Reporting Works

The Verification Process

When you sign up for a rent reporting service that offers retroactive reporting, the service will need to verify your past payments. This typically involves contacting your landlord or property manager to confirm your payment history, including move-in date, monthly rent amount, and whether payments were made on time.

Some services verify through bank account records, identifying past rent payments in your transaction history. Others rely entirely on landlord verification. Services like Rental Kharma use landlord verification, which allows them to report your entire payment history at your current address, regardless of how you pay rent.

Documentation You May Need

While requirements vary by service, having the following information ready can speed up the process: your current lease agreement, landlord or property management contact information, your move-in date, and monthly rent amount. Some services may request additional documentation to verify specific payments.

How It Appears on Your Credit Report

Once verified and reported, your rent payment history appears on your credit report as a tradeline. This tradeline shows your account opening date (typically your move-in date), your payment history month by month, and your current account status. The tradeline functions similarly to other credit accounts, contributing to your payment history and overall credit profile.

Timeline for Results

Most renters see their rental tradeline appear on credit reports within 30 to 60 days after verification is complete. The exact timeline depends on the service and how quickly credit bureaus process the information.

How Far Back Can You Report Past Rent?

Different rent reporting services offer different limits on how far back they can report your payment history.

Standard: 24-48 Months

Most rent reporting services cap retroactive reporting at 24-48 months of past payments. This is the industry standard and allows you to add two full years of payment history to your credit file. Services like Boom, LevelCredit, and many others follow this 24-month limit, often charging an additional fee for the historical reporting.

Extended: Up to 4 Years

Some services go further, with some reporting up to four years of past rent payments. This extended history can be particularly valuable for long-term renters who have established a substantial track record at their current residence.

Unlimited: Entire History at Current Address

Rental Kharma stands apart by offering to report your entire payment history at your current address, with no arbitrary time limit. If you’ve lived at your current residence for five, seven, or even ten years, Rental Kharma can report that full history. This approach maximizes the value of your payment track record and can have a more significant impact on your credit profile.

Why More History Matters

Generally, more payment history translates to greater credit-building impact. A longer track record of on-time payments demonstrates sustained financial responsibility, which credit scoring models reward. If you have the option to report more history, it’s usually worth doing so.

Tips for Reporting Past Rent Payments Successfully

Gather Your Documentation

Before signing up for a service, collect your lease agreement, landlord contact information, move-in date, and monthly rent amount. Having this information ready speeds up the enrollment and verification process.

Give Your Landlord a Heads-Up

Most retroactive reporting requires landlord verification. Let your landlord know in advance that a rent reporting service will be contacting them to verify your payment history. A quick heads-up helps ensure they respond promptly and accurately. Most landlords are happy to help since the verification typically takes only a few minutes.

Confirm Your Payment History Is Clean

Before reporting past rent, honestly assess your payment history. If you’ve consistently paid on time, retroactive reporting will help your credit. However, if your history includes late payments, understand how the service handles them. Some services only report positive payments, while others report your complete history including late payments.

Choose a Service That Reports to Multiple Bureaus

Different lenders pull credit reports from different bureaus. A service that reports to two or three bureaus ensures your rent history appears regardless of which bureau a lender checks. Look for services that report to multiple bureaus, such as TransUnion and Equifax, which are commonly used by lenders for credit decisions.

Understand the Fee Structure

Some services include retroactive reporting in their setup fee, while others charge separately for past rent reporting. Compare the total cost, including setup fees, monthly fees, and any additional charges for historical reporting. Services that bundle retroactive reporting into the setup fee often provide better overall value.

Check Your Credit Report After Reporting

Once your past rent is reported, review your credit reports to confirm the information appears correctly. Verify that your payment history is accurate and that all months are accounted for. If you notice errors, contact the rent reporting service to have them corrected.

Best Services for Reporting Past Rent Payments

1. Rental Kharma

At Rental Kharma, we report your complete rental payment history at your current address to both TransUnion and Equifax for renters throughout the United States. Unlike services that cap retroactive reporting at 24 or 48 months, we include your full history from move-in to present, regardless of how long you’ve lived there.

Our $75 one-time setup fee includes all retroactive reporting with no additional charges for past payments. Ongoing reporting costs $8.95 per month. We use landlord verification, which means the service works with any payment method including cash, check, and money order.

Every member receives unlimited one-on-one credit mentoring to help maximize results, and the service is backed by a 90-day money-back guarantee.

2. RentReporters

RentReporters offers an extensive retroactive rent reporting window, allowing tenants to add up to 48 months (4 years) of past rent payments to their credit reports. The service reports to TransUnion and Equifax and verifies payments through your landlord.

Pricing includes a $94.95 setup fee that covers past rent reporting, with ongoing monthly plans available at $9.95 per month or $7.95 per month if paid annually.

3. Boom

Boom reports to all three major credit bureaus and offers retroactive reporting of up to 24 months of past payments for a one-time $25 fee. The service costs $3 per month for ongoing reporting.

Boom verifies payments through bank account linking, so it works best for renters who pay through digital methods rather than cash.

Make Every Past Payment Count with Rental Kharma

You’ve been paying rent on time for months or years. That track record proves you can handle a major financial commitment, but without reporting, it remains invisible on your credit report.

Rental Kharma changes that by reporting your entire payment history at your current address to TransUnion and Equifax. Not just the last months. Not a limited window. Your complete history from move-in to today.

The $75 one-time setup fee includes all retroactive reporting, so there are no surprise charges for adding your past payments. Our team handles landlord verification directly, making the process simple whether you’ve lived at your current address for one year or ten.

Beyond reporting, every member gets unlimited one-on-one credit mentoring with experts who understand how to maximize your credit-building results. We’ll help you understand your credit reports, identify opportunities, and build habits that support your long-term financial goals.

With over 12 years as a pioneer in rent reporting, we’ve helped families across the country turn their rent payments into stronger credit profiles. Our 90-day money-back guarantee means there’s no risk in getting started.

Your past rent payments represent years of financial responsibility. It’s time they appeared on your credit report.

Get Started with Rental Kharma →

Frequently Asked Questions (FAQs)

How far back can I report past rent payments?

It depends on the service you choose. Most rent reporting services offer retroactive reporting of up to 24 to 48 months. Some services, like RentReporters can report up to four years of past payments. Rental Kharma reports your entire payment history at your current address with no time limit, making it ideal for long-term renters who want to maximize their credit-building impact.

Do I need my landlord’s help to report past rent?

In most cases, yes. Services that offer retroactive reporting typically require landlord verification to confirm your payment history. This involves a brief phone call or communication with your landlord to verify your move-in date, rent amount, and payment record. Some services verify through bank account records, but landlord verification allows for reporting of cash and non-digital payments.

Does Rental Kharma charge extra for past rent reporting?

No. Rental Kharma includes all retroactive reporting in the $75 one-time setup fee. There are no additional charges for past payments, regardless of how many months or years of history you have at your current address. Many other services charge separate fees for historical reporting on top of their setup costs.

How quickly will past rent payments appear on my credit report?

After verification is complete, most renters see their rental tradeline appear on credit reports within 30 to 60 days. The exact timeline depends on the service and credit bureau processing times. Some services offer expedited reporting for an additional fee if you need faster results.

*Disclaimer: Credit score improvements vary by individual based on credit history, payment consistency, and scoring models. The results mentioned are averages and not guaranteed. For current pricing, visit Rental Kharma’s website. This article is for educational purposes only, not financial advice.