Key Takeaways

- Mortgage credit score requirements vary widely by loan type: conventional loans typically need 620+, FHA loans can approve borrowers starting at 580, USDA lenders prefer 640, and VA loans generally look for scores around 620.

- A higher credit score doesn’t just improve approval odds; it can save tens of thousands of dollars in interest over a 30-year loan and lower monthly payments.

- Strong credit-building habits such as paying bills on time, lowering credit utilization, keeping old accounts open, and avoiding unnecessary credit inquiries have the biggest impact on boosting your score.

- Building or improving credit for a mortgage typically takes six months to a year, depending on your current credit profile, how quickly you address negative factors, and how consistently you build positive history.

- Rental Kharma helps future homebuyers strengthen their credit profiles by adding years of on-time rent payments to major credit bureaus, potentially boosting scores before mortgage applications.

What Credit Score Do You Need for a Mortgage?

Your credit score requirements depend on the type of mortgage you’re seeking. Different loan programs have different minimum thresholds, and understanding these can help you set realistic goals.

Conventional Loans are the most common type of mortgage and typically require a minimum credit score of 620. However, borrowers with scores closer to 740 or higher qualify for the best interest rates and terms. These loans follow guidelines set by Fannie Mae and Freddie Mac and often require higher credit standards.

FHA Loans are government-backed mortgages designed for first-time homebuyers and those with lower credit scores. You can qualify for an FHA loan with a credit score as low as 580 if you can make a down payment of at least 3.5%. Some lenders may even work with borrowers who have scores between 500 and 579, though these cases require a 10% down payment.

VA Loans are available to eligible veterans, active-duty service members, and certain military spouses. While the VA doesn’t set a minimum credit score requirement, most lenders prefer scores of at least 620. VA loans offer excellent benefits, including no down payment requirements and competitive interest rates.

USDA Loans help buyers purchase homes in eligible rural and suburban areas. Most lenders require a minimum credit score of 640 for USDA loans, though the program itself doesn’t specify a strict minimum.

Understanding where you stand and which loan type suits your situation helps you create a targeted credit-building plan.

Rental Kharma: The Fastest Way to Significantly Improve Your Credit Score!

Average 40-Point Score Increase | 4.2★ Google Rating

Get Credit You Deserve:

Add your entire rental payment history to TransUnion and Equifax—regardless of how you pay. See an average 40-point increase in days, plus an additional 60 points in 6–8 weeks with unlimited 1-on-1 mentoring included.

What’s Included:

- ✓ $75 past reporting + $8.95/month membership

- ✓ 720 Credit Ready guidance and no down payment loan strategies

- ✓ Pitfall avoidance to identify predatory lenders

- ✓ Unlimited mentoring sessions with ongoing support

Your largest monthly payment should build your credit. Make it count.

Why Your Credit Score Matters for Home Loans

Your credit score shapes far more than loan approval; it ultimately determines the long-term cost of your mortgage. Lenders rely on this number to gauge risk, and a strong score shows you’re a reliable borrower. That reliability translates into lower interest rates, which can save you a significant amount over a 30-year loan.

A borrower with a 760 score, for example, may secure an interest rate a full percentage point lower than someone at 640. On a $300,000 mortgage, that gap can add up to $60,000–$70,000 in interest savings across the life of the loan. Monthly payments drop as well, giving you more room in your budget.

Credit scores also influence loan terms and down-payment expectations. Applicants with lower scores often face higher upfront costs or must pay for private mortgage insurance, increasing ongoing expenses.

The takeaway: strengthening your credit before applying doesn’t just help you get approved; it helps you secure terms that keep homeownership more affordable in the long run.

How to Build Credit for a Mortgage: Essential Steps

Building credit for a mortgage requires a strategic approach focused on the factors that matter most to lenders. Here are the most effective steps to strengthen your credit profile:

Pay All Bills on Time

Payment history is the single most important factor in your credit score. Even one late payment can negatively impact your score and stay on your credit report for up to seven years. Set up automatic payments or calendar reminders to ensure you never miss a due date for credit cards, car loans, student loans, utilities, or any other bills.

Lower Your Credit Utilization

Credit utilization refers to how much of your available credit you’re using. Lenders prefer to see utilization below 30%, but aiming for under 0% is even better. Pay down existing balances and avoid maxing out your cards.

Keep Old Accounts Open

The length of your credit history matters. Older accounts demonstrate long-term responsible credit management. Even if you’re not actively using an old credit card, keeping it open (with an occasional small purchase to keep it active) helps maintain a longer average account age.

Add Positive Payment History

If you’re struggling to build credit because you don’t have many accounts reporting to the credit bureaus, consider adding positive payment data. Your monthly rent is likely your largest expense, yet it typically doesn’t appear on your credit report. Services like Rental Kharma bridge this gap by reporting your rent payments to major credit bureaus, allowing you to turn years of on-time rent into credit-building assets. This approach is particularly valuable for first-time homebuyers who have been renting while saving for a down payment.

Avoid New Credit Applications

Each time you apply for new credit, a hard inquiry appears on your credit report and can temporarily lower your score. Multiple inquiries in a short period raise red flags for mortgage lenders. In the months leading up to your mortgage application, avoid opening new credit cards, financing large purchases, or applying for other loans.

Check Credit Reports for Errors

Mistakes on credit reports are more common than you might think. Request free copies of your credit reports from all three major bureaus: Equifax, Experian, and TransUnion, and review them carefully. Look for incorrect account information, payments marked late that were actually on time, accounts that don’t belong to you, or outdated negative items. Dispute any errors you find, as removing them can quickly boost your score.

Timeline: How Long Does It Take to Build Credit for a Mortgage?

The time needed to build credit for a mortgage varies based on your starting point and the actions you take.

If you’re starting with no credit history, building a score from scratch typically takes six months to a year. You’ll need to establish accounts that report to the credit bureaus and demonstrate consistent on-time payments. Opening a secured credit card, becoming an authorized user on someone else’s account, or using a rent reporting service can help accelerate this process.

If you have existing credit but need to improve your score, the timeline depends on what’s holding your score down. Paying down high credit card balances can improve your score within one to two billing cycles. Addressing errors on your credit report can lead to improvements within 30 to 60 days after the dispute is resolved.

Recovering from serious negative marks like late payments, collections, or charge-offs takes longer. Recent negative items have the most impact, but their effect diminishes over time. You may see meaningful improvement within six months to a year of establishing positive payment patterns, though the negative marks themselves remain on your report for up to seven years.

For most people aiming to improve their credit for a mortgage, a focused six-month to one-year plan yields significant results. Starting early gives you time to address issues, build a positive history, and position yourself for the best possible loan terms.

Build Credit Faster with Rental Kharma

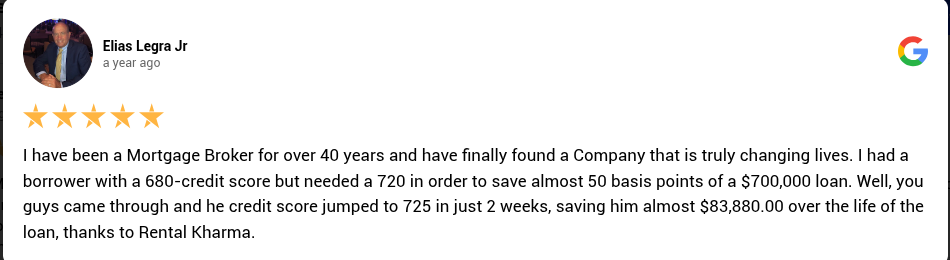

When you’re preparing to apply for a mortgage, every point on your credit score matters. Rental Kharma offers a proven solution that helps renters build credit through their largest monthly expense: rent.

Rental Kharma reports your rental payment history to TransUnion and Equifax, two of the three major credit bureaus. The $75 one-time setup fee includes reporting your entire rental history at your current address through a simple landlord verification process. Unlike services that only report future payments, Rental Kharma adds all your past on-time rent payments immediately, giving your credit score a boost right away.

Our members see significant results quickly, with many experiencing noticeable credit score improvements within days. The service works regardless of how you pay rent, whether by check, cash, money order, or electronic transfer, making it accessible to all renters.

What makes Rental Kharma especially valuable for future homebuyers is our unlimited one-on-one mentoring program. Our credit experts work with you to develop a comprehensive strategy for reaching your credit goals, including the specific score ranges that will qualify you for the best mortgage rates. Members who complete our mentoring sessions develop clear action plans for strengthening their credit profiles before applying for home loans.

With over 12 years of experience helping more than 125,000 families, a 90-day money-back guarantee, and transparent pricing, Rental Kharma makes credit-building practical and effective for aspiring homeowners.

Get Started with Rental Kharma →

Frequently Asked Questions (FAQs)

How long should I wait after improving my credit score before applying for a mortgage?

Once you’ve made improvements, wait at least one to two billing cycles to ensure the positive changes appear on your credit reports. Most lenders pull credit reports from all three bureaus, so verify that updates have been processed before submitting your application. If you’ve added new positive payment history like rent reporting, allow 7 to 10 business days for it to appear on your reports.

Can I get a mortgage with a low credit score?

Yes, certain loan programs accept lower credit scores. FHA loans can work with scores as low as 580, and sometimes even lower with larger down payments. However, lower scores typically mean higher interest rates and more restrictive terms. Working to improve your score before applying, even by 20 to 40 points, can make a significant difference in your loan costs.

Will checking my credit score hurt my mortgage application?

No. Checking your own credit score is a “soft inquiry” that doesn’t affect your credit. You can and should check your credit regularly as you prepare for a mortgage application. Only “hard inquiries” from lenders reviewing your credit for lending decisions can temporarily lower your score.

How can Rental Kharma help me prepare for a mortgage application?

Rental Kharma strengthens your credit profile by adding your full rental payment history to TransUnion and Equifax, often resulting in score improvements within days. For future homebuyers, this means you can boost your credit while saving for a down payment, potentially qualifying for better mortgage rates and terms. Our unlimited mentoring also helps you develop a targeted plan to reach the credit scores that unlock the most favorable loan options.

*Disclaimer: Credit score improvements vary by individual based on credit history, payment consistency, and scoring models. The results mentioned are averages and not guaranteed. For current pricing, visit Rental Kharma’s website. This article is for educational purposes only, not financial advice.