Key Takeaways

- Zero credit means having no history with the major credit bureaus, making it hard to access loans, credit cards, or rental opportunities.

- Rental Kharma solves credit invisibility by reporting your full rental history to TransUnion and Equifax, helping previously unscorable individuals build their first credit score (averaging 600–640) within days, rather than waiting 6+ months to establish credit through traditional methods.

- Next get a secured credit card and paying balances on time builds credit history and establishes responsible credit habits.

- Becoming an authorized user on someone else’s credit card can boost your score quickly by adding their positive payment history to your report.

- Consistently paying on time, keeping balances low, monitoring your credit reports, and being patient are essential practices for steadily building credit from zero.

What Does “Zero Credit” Mean?

Having zero credit, also known as being “credit invisible,” means you have no credit history with the three major credit bureaus: Equifax, Experian, and TransUnion. This differs significantly from having bad credit. Bad credit means you have a history of negative marks, like missed payments or defaults. Zero credit means lenders simply have no data to evaluate your creditworthiness.

According to the Consumer Financial Protection Bureau, approximately 26 million American adults are credit invisible, while another 19 million have credit files too thin to generate a credit score. Young adults, recent immigrants, and individuals who’ve operated solely on cash are most likely to face this challenge.

Without a credit score, you’ll struggle to qualify for credit cards, auto loans, or mortgages. Many landlords reject rental applications without a credit history, and some employers check credit as part of background screening. Even when you do qualify for credit, you’ll face higher interest rates that cost thousands of dollars over the life of a loan.

Rental Kharma: The Fastest Way to Significantly Improve Your Credit Score!

Average 40-Point Score Increase | 4.2★ Google Rating

Get Credit You Deserve:

Add your entire rental payment history to TransUnion and Equifax—regardless of how you pay. See an average 40-point increase in days, plus an additional 60 points in 6–8 weeks with unlimited 1-on-1 mentoring included.

What’s Included:

- ✓ $75 past reporting + $8.95/month membership

- ✓ 720 Credit Ready guidance and no down payment loan strategies

- ✓ Pitfall avoidance to identify predatory lenders

- ✓ Unlimited mentoring sessions with ongoing support

Your largest monthly payment should build your credit. Make it count.

Why Building Credit from Zero Matters

Your credit score influences nearly every significant financial decision throughout your life. A strong credit score unlocks lower interest rates on mortgages, auto loans, and credit cards. The difference between excellent and fair credit can mean paying $100,000 more in interest on a 30-year mortgage.

Beyond borrowing, credit affects insurance premiums, utility security deposits, and even employment opportunities. Building credit early creates financial flexibility and saves money for decades to come.

The good news? Building credit from scratch is often faster and simpler than repairing damaged credit. With the right strategies and consistent habits, most people can establish a good credit score within 6 to 12 months.

Strategies to Build a Credit Score from Zero

Strategy 1: Report Your Rent Payments

Most renters pay between $1,000 and $2,000 in rent each month, yet these payments don’t automatically build credit. Unlike mortgages or car loans, landlords typically don’t report rent payments to credit bureaus because they lack the infrastructure or find the process too costly.

Rent reporting services bridge this gap by verifying your payment history and reporting it to credit bureaus. This strategy is particularly valuable for credit-invisible individuals because it instantly creates an account for your payment history on your credit report.

Services like Rental Kharma specialize in reporting your full rental history to TransUnion and Equifax, most people see an initial score between 640 and 680 after adding 24 months of rent.

The most significant advantage of rent reporting is that you’re already making these payments. Unlike secured cards that require deposits or authorized user arrangements that depend on others, rent reporting converts existing expenses into credit-building opportunities without changing your financial behavior.

Strategy 2: Become an Authorized User

Becoming an authorized user on someone else’s credit card account offers an instant shortcut to building credit. When the primary cardholder adds you as an authorized user, their entire payment history for that account can appear on your credit report—including years of positive payment history accumulated before you were added.

This strategy works best when the primary cardholder has excellent credit, maintains low balances, and always pays on time. Ideally, choose someone responsible, like a parent or spouse, who’s had the account for several years, has a high credit limit, and has a spotless payment record.

Not all credit card issuers report authorized user accounts to all three bureaus, so verify reporting practices before proceeding. American Express, Chase, and Citi generally report authorized users, while some smaller issuers may not.

The primary risk involves the primary cardholder’s behavior. If they miss payments or max out the card after you’re added, those negative marks can damage your credit too. Have an honest conversation about expectations and consider setting up account alerts.

You don’t need to use the card to benefit from authorized user status. Simply being listed on the account builds your credit. However, the primary cardholder remains legally responsible for all charges.

Strategy 3: Start with a Secured Credit Card

Secured credit cards are specifically designed for people building or rebuilding credit. Unlike traditional credit cards that extend credit based on your creditworthiness, secured cards require a refundable security deposit that typically ranges from $200 to $2,000. This deposit becomes your credit limit and protects the card issuer if you don’t pay.

The beauty of secured cards is that they function exactly like regular credit cards and report to all three major credit bureaus. Major banks like Discover, Capital One, and Bank of America offer secured card options with reasonable terms.

To maximize credit-building with a secured card, charge small, recurring expenses like streaming subscriptions or gas, then pay the full balance each month before the due date. Keeping your credit utilization below 30% of your limit is actually bad advice, 0% is the best. You can simply put one item on the card like a Netflix subscription and put it on auto pay to pay the bill in full each month. This will give you the activity you need. 30% of your credit score is how you use a credit card. Not having a card is like skipping 30% of a math test. You would have to ace the rest of the test to get a C-.

Most secured cardholders see their first credit score appear within three to six months of responsible use. After 12 to 18 months of on-time payments, many issuers graduate you to an unsecured card and return your deposit.

Additional Tips for Building Credit from Zero

Beyond the three primary strategies, several fundamental practices accelerate credit building:

- Always pay on time: Payment history accounts for 35% of your FICO score, making it the most critical factor. Set up automatic payments or calendar reminders to never miss a due date.

- Monitor your credit reports: Visit AnnualCreditReport.com to check your credit reports from all three bureaus for free annually. Verify that accounts appear correctly and dispute any errors immediately.

- Be patient and consistent: Building credit from zero takes time. Most people need six months of credit activity before generating their first score, and reaching good credit (670+) typically takes 12 to 18 months of responsible behavior.

- Diversify your credit mix gradually: Once established, having different types of credit, such as revolving credit (e.g., credit cards) and installment loans (e.g., auto loans), strengthens your profile. However, don’t rush to open multiple accounts simultaneously.

Common Mistakes to Avoid When Building Credit

Building credit from zero requires avoiding these costly mistakes that slow progress or create setbacks:

- Applying for too many accounts too quickly generates hard inquiries that temporarily lower scores and suggest financial desperation to lenders. Space applications at least six months apart.

- Missing payments devastates new credit profiles. A single 30-day late payment can drop your score by 80 to 100 points and can impact your score for 2 years.

- Maxing out credit cards signals financial stress and dramatically increases credit utilization. Even if you pay the balance in full each month, high reported balances hurt your score.

- Closing your first credit card once upgraded eliminates your oldest account and shortens your average credit age, which comprises 15% of your FICO score.

- Ignoring credit reports means errors and fraudulent accounts can persist unnoticed, damaging your credit-building efforts.

Build Credit from Zero with Rental Kharma

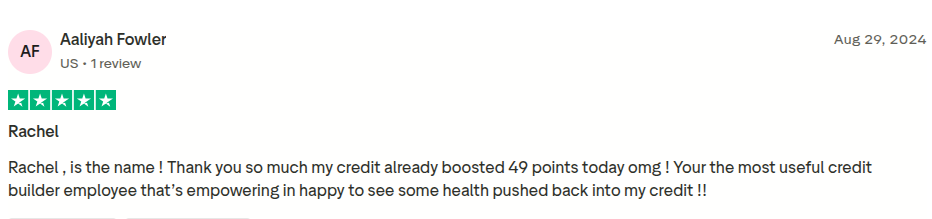

When you’re starting from zero credit, Rental Kharma offers a proven solution backed by over 12 years of experience helping more than 125,000 families establish and build credit.

Rental Kharma reports your complete rental payment history to TransUnion and Equifax, giving you immediate credit-building power. The $75 one-time setup fee includes reporting ALL past rental payments at your current address through a simple 5-minute landlord verification call. Unlike other services, there are no hidden charges for retroactive reporting.

For credit-invisible individuals, this means instantly creating a payment history account rather than waiting months to accumulate data. The average member sees a 40-point increase within days, with many previously unscorable consumers generating their first credit scores in the 640–680 range.

What truly sets Rental Kharma apart is unlimited one-on-one mentoring. Our credit experts guide you through the entire credit-building journey, helping you understand your reports, develop smart financial habits, and work toward the goal of a 720 credit score. Members who complete the 30-minute mentoring session see an average increase of 60 points in just 6 to 8 weeks.

With same-day verifications, transparent pricing, a 90-day money-back guarantee, and dedicated support, Rental Kharma makes building credit from zero accessible and practical.

Get Started with Rental Kharma →

Frequently Asked Questions (FAQs)

What credit score should I aim for as a beginner?

Initial goals should focus on becoming scorable (achieving a score above 300) and then on reaching fair credit (580+) within your first year. From there, work toward good credit (670+) by 18 to 24 months. Excellent credit (740+) typically requires three to five years of diverse, positive credit history.

Focus on consistent on-time payments and responsible credit utilization rather than obsessing over specific score targets.

How long does it take to build credit from zero?

Most people need 3 to 6 months of credit activity before their first credit score is generated. Reaching a fair score (580–669) typically takes 6 to 12 months of consistent on-time payments. Achieving good credit (670+) usually requires 12 to 18 months.

Using multiple strategies simultaneously, such as combining a secured card with rent reporting, can accelerate this timeline.

Can I build credit without a credit card?

Rent reporting proves particularly effective for credit-invisible individuals because it converts existing monthly expenses into credit-building data without requiring new financial products or deposits.

How does Rental Kharma help people with no credit history?

Rental Kharma reports your full rental payment history to TransUnion and Equifax, instantly creating a payment account on your credit report. For people with zero credit, this transforms them from “unscorable” to scorable within days.

Our service includes reporting all past payments at your current address, plus unlimited mentoring to develop strong long-term credit habits, making it one of the most comprehensive solutions for establishing credit from scratch.

*Disclaimer: Credit score improvements vary by individual based on credit history, payment consistency, and scoring models. The results mentioned are averages and not guaranteed. For current pricing, visit Rental Kharma’s website. This article is for educational purposes only, not financial advice.