How to buy a Car with No Down Payment

It's easy when you know the processTest your knowledge and you could win free rent reporting

Why are we conditioned to think we need to have a down payment to buy a car?

If you go to your bank and get a personal loan for $2,000 do they require a down payment? No they don't, and a car loan is a secured loan(the car) vs a personal loan.

Remember car dealers sell cars, they are not a bank.

Car dealers make a commission with they match you with an auto lender of their choice.

Why you should AVOID getting an auto loan at the dealer!

NEVER Give the car dealership your Social Security Number

You will get dozens of hard inquiries on your credit report causing a BIG score drop

These inquiries happen when the car dealer puts your social security number into a system that brokers your car loan to dozens of car lenders

When your credit score is below 640 it is VERY LIKELY you will end up in a predatory car loan

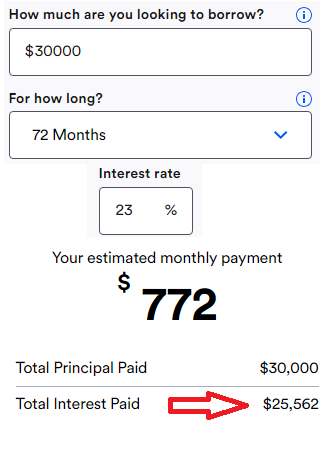

Your interest rate will end up being well above 15% and as high as 30%

This insane interest rate will cause you to pay for the car twice by the time you pay it off. See the calculators below for the math!

The Solution is Simple

Visit your local community credit unionMake sure you have a Credit Score ► Above 650, preferably a 720 All those extra points are like likes on Facebook. They just make you feel good, they don't affect your interest rate.

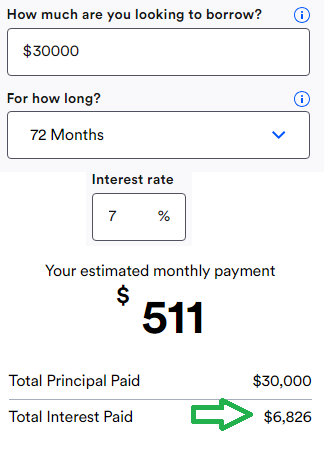

With a 650 credit score you are likely to get your preapproval at an Interest Rate of 10% or less

With a 720 credit score you are likely to get your preapproval at an Interest Rate of 5% or less

There is NO Down Payment required at the credit unionUnless you have a unique situation

You will have only 1 Hard Inquiry on 1 of your credit reports

You get to pick your lender and credit unions are know to be very customer friendlyThey help you in times of job loss like a government shut down

Test your knowledge and you could win free rent reporting

Why is Rent Reporting helpful?